The best bookkeeping app can revolutionize the way you manage your finances, empowering you with the tools and insights to streamline your operations, make informed decisions, and achieve financial success. This comprehensive guide will delve into the essential features, functionalities, and considerations when selecting the optimal bookkeeping app for your business.

User Interface and User Experience (UX)

User Interface (UI) and User Experience (UX) are crucial elements of bookkeeping apps, as they directly impact the efficiency and accuracy of bookkeeping tasks. A user-friendly interface simplifies navigation, enhances data entry, and reduces errors, leading to more efficient and accurate bookkeeping practices.

Intuitive Navigation

Intuitive navigation allows users to easily find and access the features they need without confusion or frustration. Clear menus, logical organization, and well-placed buttons contribute to a seamless user experience. For instance, the Xero app features a straightforward dashboard that provides quick access to key financial data, invoices, and reports.

Clear Dashboards

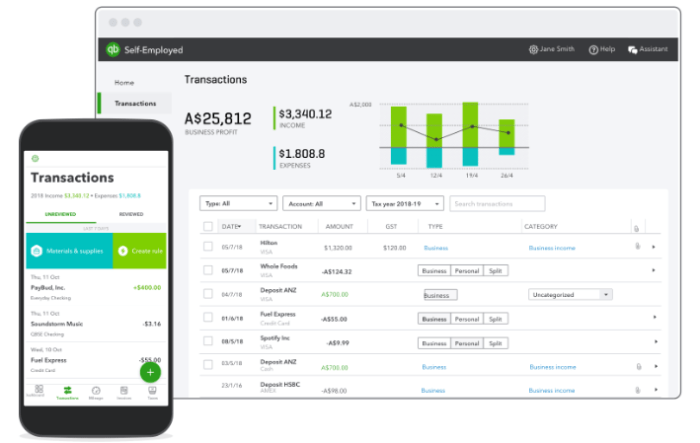

Well-designed dashboards provide a comprehensive overview of financial data, enabling users to monitor key metrics and identify trends at a glance. Customizable dashboards allow users to tailor the display to their specific needs and preferences. QuickBooks Online offers customizable dashboards that can be tailored to display specific financial reports, charts, and graphs.

Features and Functionality

Effective bookkeeping apps provide an array of essential features to streamline financial management tasks. These features include:

Invoice Management

- Create and send professional invoices

- Track invoice status (sent, viewed, paid)

- Automate invoice reminders and follow-ups

Expense Tracking

- Capture expenses through receipts, mileage, and other methods

- Categorize and organize expenses for easy analysis

- Integrate with credit cards and bank accounts for automatic expense import

Financial Reporting

- Generate customized financial reports (e.g., profit and loss, balance sheet)

- Export reports in various formats (e.g., PDF, Excel)

- Provide real-time financial insights and forecasting capabilities

Unique Capabilities and Integrations

Different bookkeeping apps offer unique capabilities and integrations to cater to specific business needs. Some notable features include:

- Integration with e-commerce platforms (e.g., Shopify, WooCommerce)

- Payroll processing and tax compliance

- Project accounting and time tracking

- Machine learning-powered expense categorization and fraud detection

Impact of Automation and Machine Learning

Automation and machine learning are revolutionizing the functionality of bookkeeping apps. These technologies enable:

- Automatic data entry and reconciliation

- Real-time financial updates and insights

- Improved accuracy and efficiency in bookkeeping tasks

- Enhanced fraud detection and prevention capabilities

Security and Data Protection

When it comes to bookkeeping apps, data security is paramount. These apps handle sensitive financial information, and it’s crucial that they implement robust measures to protect it from unauthorized access and breaches.

Reputable bookkeeping apps employ industry-standard security protocols to ensure the confidentiality and integrity of user data. These measures include:

Encryption

Encryption is a process that transforms data into an unreadable format, making it inaccessible to unauthorized parties. Bookkeeping apps use strong encryption algorithms, such as AES-256, to encrypt data both in transit and at rest.

When it comes to managing your finances, a top-rated bookkeeping app can simplify your life. But if you’re looking to stay active and fit, there are plenty of free workout apps for women available to help you achieve your fitness goals.

These apps offer tailored workouts, nutritional guidance, and progress tracking, making it easier than ever to stay on top of your health and well-being. And when it’s time to crunch the numbers, your trusted bookkeeping app will be there to help you stay organized and financially sound.

Authentication and Authorization

Authentication and authorization mechanisms prevent unauthorized access to user accounts and data. Apps typically require users to create strong passwords and may implement additional security measures such as two-factor authentication.

Compliance with Data Privacy Regulations

Bookkeeping apps must comply with data privacy regulations such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA). These regulations impose strict requirements on how businesses collect, use, and disclose personal data.

For those looking to streamline their finances, the best bookkeeping apps offer comprehensive solutions. These apps simplify expense tracking, invoicing, and financial reporting. However, if you’re seeking ways to supplement your income, exploring best apps to make money can provide valuable opportunities.

While these apps may not directly relate to bookkeeping, they can complement your financial management by generating additional revenue streams. Thus, the best bookkeeping app can not only assist in managing your finances but also connect you to income-generating opportunities.

Integrations and Compatibility

Seamless integrations with other business tools enhance the capabilities of bookkeeping apps. By connecting with accounting software, payment gateways, and CRM systems, these apps streamline workflows and foster collaboration.

Integrations with accounting software automate data transfer, reducing errors and saving time. They eliminate manual data entry and ensure accuracy, leading to efficient financial management.

Payment Gateway Compatibility

- Integrations with payment gateways enable secure and convenient online transactions.

- Bookkeeping apps that support multiple payment gateways provide flexibility and cater to diverse business needs.

CRM System Compatibility, Best bookkeeping app

- Integration with CRM systems enhances customer relationship management by providing a consolidated view of customer interactions.

- This integration streamlines communication, improves sales tracking, and enhances overall customer service.

Platform Compatibility

Compatibility with various platforms and operating systems is crucial for seamless use. Apps that offer support for multiple platforms, including Windows, macOS, iOS, and Android, ensure accessibility and flexibility.

Cloud-based bookkeeping apps offer cross-platform compatibility, allowing users to access their data from any device with an internet connection.

Pricing and Value for Money: Best Bookkeeping App

The pricing models for bookkeeping apps vary, including subscription fees, usage-based pricing, and one-time purchases. Subscription fees offer a monthly or annual payment for access to the app’s features, while usage-based pricing charges based on the volume of transactions or data processed.

One-time purchases involve a single payment for lifetime access to the app.

When evaluating the value proposition of bookkeeping apps, consider their features, functionality, and cost. Apps with comprehensive features and functionality may offer greater value, even at a higher cost. Conversely, apps with limited features may be more cost-effective for basic bookkeeping needs.

Factors to Consider for ROI

- Time Savings:Assess the time saved by automating bookkeeping tasks, freeing up time for other business activities.

- Accuracy and Compliance:Consider the app’s ability to improve accuracy and ensure compliance with accounting standards.

- Increased Efficiency:Evaluate how the app streamlines workflows and enhances overall bookkeeping efficiency.

- Data Security:Assess the app’s security measures to protect sensitive financial data.

- Return on Investment:Calculate the potential return on investment based on the cost of the app and the value it provides.

Final Review

Choosing the best bookkeeping app is a crucial decision that can significantly impact the efficiency, accuracy, and security of your financial management. By carefully evaluating the factors discussed in this guide, you can select an app that aligns with your specific business needs, allowing you to harness the power of technology to simplify your bookkeeping tasks and unlock new levels of financial control.