In the realm of fintech, best cash apps reign supreme, offering unparalleled convenience, speed, and cost-effectiveness for managing your finances. Join us as we delve into the world of digital money, exploring the top cash apps, their key features, and how they can revolutionize your financial life.

Whether you’re a seasoned pro or just starting your journey into cashless transactions, this comprehensive guide will provide you with all the information you need to make informed decisions and choose the best cash app for your specific needs.

Overview of Best Cash Apps

Cash apps have revolutionized the way we manage our finances, offering a convenient and secure alternative to traditional banking methods. These apps allow users to send and receive money, pay bills, and manage their budgets, all from the convenience of their smartphones.

Here is a comprehensive list of the top cash apps currently available, along with their key features, benefits, and drawbacks:

Venmo

- Key Features: Social payments, peer-to-peer transfers, split bills, mobile payments.

- Benefits: User-friendly interface, social features, wide merchant acceptance.

- Drawbacks: Limited financial services, fees for certain transactions.

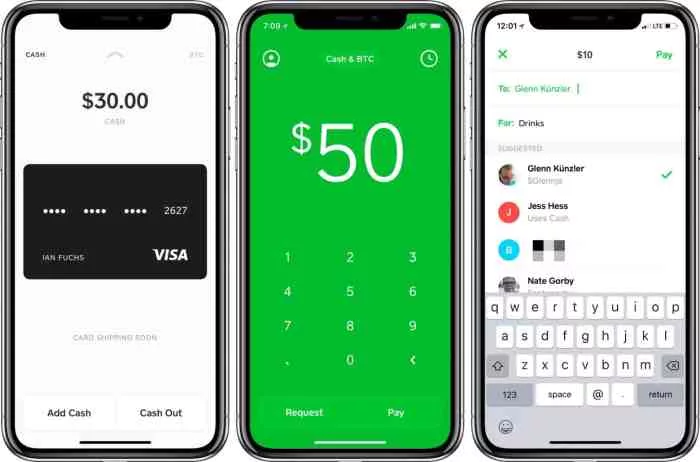

Cash App

- Key Features: Peer-to-peer transfers, direct deposits, debit card, Bitcoin trading.

- Benefits: Low fees, fast transfers, integrated Bitcoin trading.

- Drawbacks: Limited bill pay options, customer service issues.

PayPal

- Key Features: Global payments, online shopping, invoicing, merchant services.

- Benefits: Widely accepted, high security, business-friendly features.

- Drawbacks: Higher fees for some transactions, limited customer support.

Zelle

- Key Features: Instant peer-to-peer transfers, bank-backed security.

- Benefits: Fast, secure, no fees for most transactions.

- Drawbacks: Limited features, only available to customers of participating banks.

Google Pay

- Key Features: Mobile payments, peer-to-peer transfers, bill pay, loyalty rewards.

- Benefits: Wide merchant acceptance, integrated with Google services.

- Drawbacks: Limited financial services, potential for data tracking.

Apple Pay

- Key Features: Mobile payments, peer-to-peer transfers, contactless payments.

- Benefits: Secure, convenient, widely accepted.

- Drawbacks: Only available to Apple device users, limited financial services.

Factors to Consider When Choosing a Cash App

When selecting a cash app, there are several important factors to consider. These factors can impact the overall experience and the suitability of the app for your specific needs.

Managing your finances effectively is essential, and the best cash apps can streamline this process. To enhance your productivity further, consider exploring the best time management apps. These tools empower you to optimize your schedule, prioritize tasks, and maximize your efficiency.

By leveraging both best cash apps and time management apps, you can achieve financial success while maintaining a balanced and organized life.

Some of the key factors to consider include:

Fees

- Cash apps often charge fees for certain transactions, such as sending money, receiving money, or withdrawing funds.

- The fee structure can vary significantly between different apps, so it’s important to compare fees before selecting an app.

- Consider the types of transactions you’ll be making and the frequency of those transactions to determine which fee structure is most cost-effective for you.

Security Measures

- Cash apps should employ robust security measures to protect user data and financial information.

- Look for apps that use encryption, two-factor authentication, and other security protocols to safeguard your account.

- Read reviews and check the app’s security features before making a decision.

Ease of Use

- The app should be easy to navigate and use, even for those who are not tech-savvy.

- Consider the user interface, the clarity of instructions, and the overall functionality of the app.

- A user-friendly app will make it easier for you to manage your finances and make transactions.

Customer Support

- Reliable customer support is essential in case you encounter any issues or have questions about the app.

- Look for apps that offer multiple channels for customer support, such as email, phone, or live chat.

- Responsive and helpful customer support can provide peace of mind and ensure that your concerns are addressed promptly.

Detailed Analysis of Top Cash Apps: Best Cash Apps

The table below compares the key features and differences between the top cash apps in the market. These apps offer various features, fees, security measures, ease of use, and customer support options. Understanding these aspects can help users make an informed decision when selecting the best cash app for their needs.

The comparison table highlights the strengths and weaknesses of each app, allowing users to assess which app aligns best with their priorities and requirements. It provides a comprehensive overview of the key aspects to consider when choosing a cash app.

Comparison Table of Top Cash Apps

| App Name | Fees | Security Features | Ease of Use | Customer Support |

|---|---|---|---|---|

| Venmo |

|

|

|

|

| PayPal |

|

|

|

|

| Zelle |

|

|

|

|

| Cash App |

|

|

|

|

Use Cases and Benefits of Cash Apps

Cash apps are digital payment platforms that enable users to send and receive money, often in real-time, using their smartphones or other mobile devices. They have become increasingly popular due to their convenience, speed, and cost-effectiveness. In this section, we will explore some specific use cases and benefits of cash apps.

Everyday Use Cases

- Peer-to-peer payments:Cash apps allow users to send money to friends, family, or colleagues instantly, making it easy to split bills, repay debts, or contribute to group expenses.

- Online shopping:Many cash apps offer virtual cards or payment options that can be used to make purchases online, providing a secure and convenient alternative to traditional credit or debit cards.

- In-store payments:Some cash apps support in-store payments using QR codes or NFC technology, allowing users to pay for goods and services without the need for physical cash or cards.

- Bill payments:Cash apps can be used to pay utility bills, rent, and other recurring expenses, often with the option to set up automatic payments for convenience.

- Donations and crowdfunding:Cash apps make it easy to donate to charities or support crowdfunding campaigns, allowing users to contribute to causes they care about.

Benefits of Using Cash Apps, Best cash apps

- Convenience:Cash apps eliminate the need for physical cash or cards, making payments and money transfers quick and easy from anywhere with an internet connection.

- Speed:Transactions processed through cash apps typically settle in real-time, ensuring instant transfer of funds between users.

- Cost-effectiveness:Many cash apps offer free or low-cost transactions, making them a more affordable alternative to traditional banking services or money transfer services.

- Financial management:Some cash apps provide features such as budgeting tools, transaction tracking, and expense categorization, helping users manage their finances more effectively.

- Security:Cash apps employ robust security measures, including encryption and fraud protection, to safeguard user data and transactions.

Security and Privacy Considerations

Cash apps offer convenience and efficiency, but they also introduce security and privacy concerns. Understanding these risks and implementing best practices is crucial to protect user data and prevent fraud.

Regulatory bodies worldwide are actively involved in overseeing cash apps. They establish compliance requirements to ensure the safety and privacy of user information. These regulations may include data protection laws, anti-money laundering measures, and consumer protection guidelines.

Tips for Protecting User Data

- Use strong passwords and enable two-factor authentication to secure your account.

- Be cautious when sharing personal information, such as your Social Security number or bank account details.

- Only download cash apps from official app stores and verify their authenticity before installing.

- Regularly monitor your transaction history and report any suspicious activity to the cash app provider.

Preventing Fraud

- Avoid sending money to individuals or businesses you don’t know or trust.

- Be wary of phishing scams that attempt to steal your login credentials or personal information.

- Use a reputable cash app that employs robust security measures and fraud detection systems.

Final Conclusion

As we conclude our exploration of best cash apps, it’s clear that these digital tools have become indispensable for modern money management. Their ease of use, security features, and wide range of benefits make them an essential part of any financial toolkit.

Embrace the future of finance and unlock the power of best cash apps to simplify your life and achieve your financial goals.